The American Rescue Plan Act (ARP) of 2021 was signed into law on March 11, 2021.

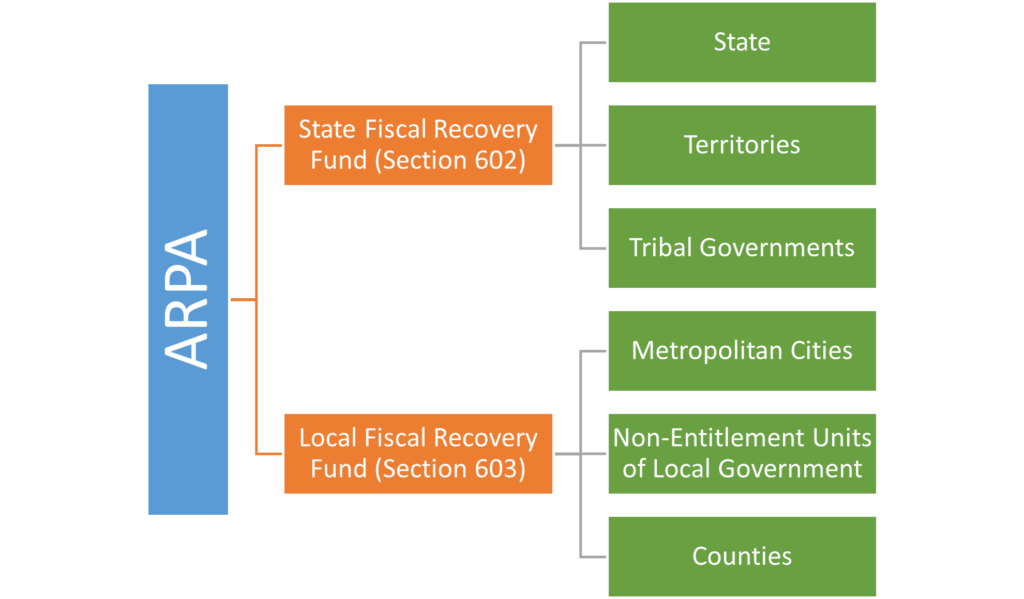

The U.S. Department of Treasury issued the Interim Final Rule for two programs of the ARPA, the Coronavirus State Fiscal Recovery Fund (SFRF) and the Coronavirus Local Fiscal Recovery Fund (LFRF). The primary difference between the two sections is that Section 602, which established the SFRF, refers to State, Territories, and Tribal Governments and Section 603, which established the LFRF, relates to metropolitan cities, non-entitlement units of local government, and counties.

Section 602 and 603 both have four categories of eligible uses: public health and economic impacts, premium pay, government services/revenue loss, and investments in infrastructure.

In addition, Congress clarified two types of uses which do not fall within these four categories. Sections 602 and 603 state that specifically ineligible uses are depositing funds into any pension fund and Section 602 also excludes directly or indirectly offsetting a reduction in the net tax revenue of the State or territory. The four categories of eligible uses are summarized below.

The four categories of eligible uses are summarized below.

Public Health and Economic Impact

The SFRF and LFRF provide resources to meet the wide range of public health and economic impacts of the COVID-19 public health emergency and authorizes the use of payments from the Fiscal Recovery Fund (FRF) to respond to the public health emergency or its negative economic impacts, including assistance to households, small businesses, and nonprofits, or aid to impacted industries such as tourism, travel, and hospitality. To assess whether a program or service is included in this category of eligible uses, a recipient should consider whether and how the use would respond to the COVID- 19 public health emergency. Assessing whether a program or service “responds to” the COVID-19 public health emergency requires the recipient to, first, identify a need or negative impact of the COVID-19 public health emergency and, second, identify how the program, service, or other intervention addresses the identified need or impact. Eligible uses under this category must be in response to the disease itself or the harmful consequences of the economic disruptions resulting from or exacerbated by the COVID-19 public health emergency.

Premium Pay

Fiscal Recovery Fund (FRF) payments may be used by recipients to provide premium pay to eligible workers performing essential work during the COVID-19 public health emergency or to provide grants to third-party employers with eligible workers performing essential work. Eligible workers must have regular in-person interactions or regular physical handling of items that were also handled by others. This will help respond to the needs of essential workers by allowing recipients to compensate essential workers for the elevated health risks they have faced and continue to face during the public health emergency.

Continuity of Government Services

Recipients may use payments from the FRF for the provision of government services to the extent of the reduction in revenue due to the COVID–19 public health emergency. The reduction in revenue is measured relative to the revenue collected in the most recent full fiscal year prior to the emergency. Many governments are experiencing significant budget shortfalls which can have a devasting impact on communities. Interest, principal and issuance costs on new/outstanding debts, as well as replenishing financial reserves are specifically excluded uses of these funds. The SFRF and LFRF permit recipients to avoid cuts to government services and allows governments to continue to provide valuable services and ensure that fiscal austerity measures do not impede the broader economic recovery.

Investments in Infrastructure

The ARPA recognizes the critical role that clean drinking water and services for the collection and treatment of wastewater and stormwater play in protecting public health. To assist in meeting the need for investments and improvements to existing infrastructure in water, sewer, and broadband, the FRF provides funds to make necessary investments in these sectors. The Interim Final Rule outlines eligible uses within each category, allowing for a broad range of necessary investments in projects that improve access to clean drinking water, improve wastewater and stormwater infrastructure systems, and provide access to high-quality broadband service.

By aligning use of Fiscal Recovery Funds with the categories or types of eligible projects under the existing EPA state revolving fund programs, the Interim Final Rule provides recipients with the flexibility to respond to the needs of their communities while ensuring that investments in water and sewer infrastructure made using FRF are necessary.

Overarching Restrictions

The ARPA includes two provisions that further define the boundaries of the statute’s eligible uses. Sections 602 and 603 prohibit any recipient from using the FRF for deposit into any pension fund. In addition, Section 602 states that the funds may not be used to directly or indirectly offset a reduction in net tax revenue resulting during the covered period. These restrictions support the use of funds for the congressionally permitted purposes stated in the Interim Final Rule, and outlined above, by providing protection against the use of funds for purposes outside of the four eligible use categories.

[1] https://www.cbpp.org/research/state-budget-and-tax/its-time-for-states-to-invest-in-infrastructure

[2] https://home.treasury.gov/system/files/136/FRF-Interim-Final-Rule.pdf